capital gains tax news canada

For people with visual impairments the following alternate formats are also available. Web Budget 2023 Expectations LTCG STCG.

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Web India taxes investment gains based on a lock-in or holding period.

. Web The inclusion rate is the percentage of your gains that are subject to tax. The inclusion rate has varied over time see graph below. Your source for the latest Canadian tax news and updates on changing tax laws.

Investments in equity or equity-linked mutual funds for more than one year are. Web For example if youre single with a taxable income of 40000 in 2022 you qualify for the 0 rate on long-term capital gains for that tax year. As of 2022 it stands at 50.

Web The Ontario chapter proposed reducing the capital gains tax exemption to zero meaning all investment gains would be taxed as income. Web When it comes to capital gains tax in the provinces capital gains is calculated the exact same way as it is federally with 50 of the capital gain being taxed according. Web The government is planning to change its capital gains tax structure in the Budget 2023-24 to bring parity in various asset classes like equity debt and immovable.

Web The records with the CDS and Clearing show that the countrys stock exchange market contributed capital gains tax of Rs 7 billion in the states coffers during. Web Canadas capital gains tax was introduced in part to finance the growing costs of Canadas social security system and to create a more equitable system of taxation. Web In 1990 for instance the Conservative government raised the capital gains tax to 75 with the Liberal government returning it to 50 in the years after.

There has been speculation from advisors and investors that capital gains taxes. There is an expectation that he will lower the threshold at which the top 45p. Web The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax.

If your income grew. Web Currently under Canadian tax law only 50 of capital gains are taxable at your marginal rate. The new rate would aim to bring taxes on capital gains in line.

Web The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the. Web The Biden plan would hike the top capital gains tax rate from the current 20 per cent to 396 per cent. Web PDF t4037-21epdf.

Web For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. So for example if you buy a stock at 100 and it earns 50 in value when you sell it the. Web The briefings that have been issued so far suggest that Mr Hunt will only go halfway.

Web President Biden wants to raise the capital gains tax that wealthy people pay and use the extra revenue to fund new social spending on children and education. Web The capital gains tax is the same for everyone in Canada currently 50. Working collaboratively with the Canada Revenue.

As part of the same. Web When as Canadas minister of state for housing I proposed mortgage payment deductibility to make home ownership more affordable I was told we would. The Budget for 2023-24 fiscal would be presented in Parliament on February 1 2023.

Web Canadian tax news.

Capital Gains Tax Rates For 2022 And 2023 Forbes Advisor

Capital Gains Losses From Selling Assets Reporting And Taxes

Democrats Seek Backup Plan On Taxing Capital Gains Wsj

Double Taxation Of Corporate Income In The United States And The Oecd

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Canada Crypto Tax Guide 2022 Crypto News

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

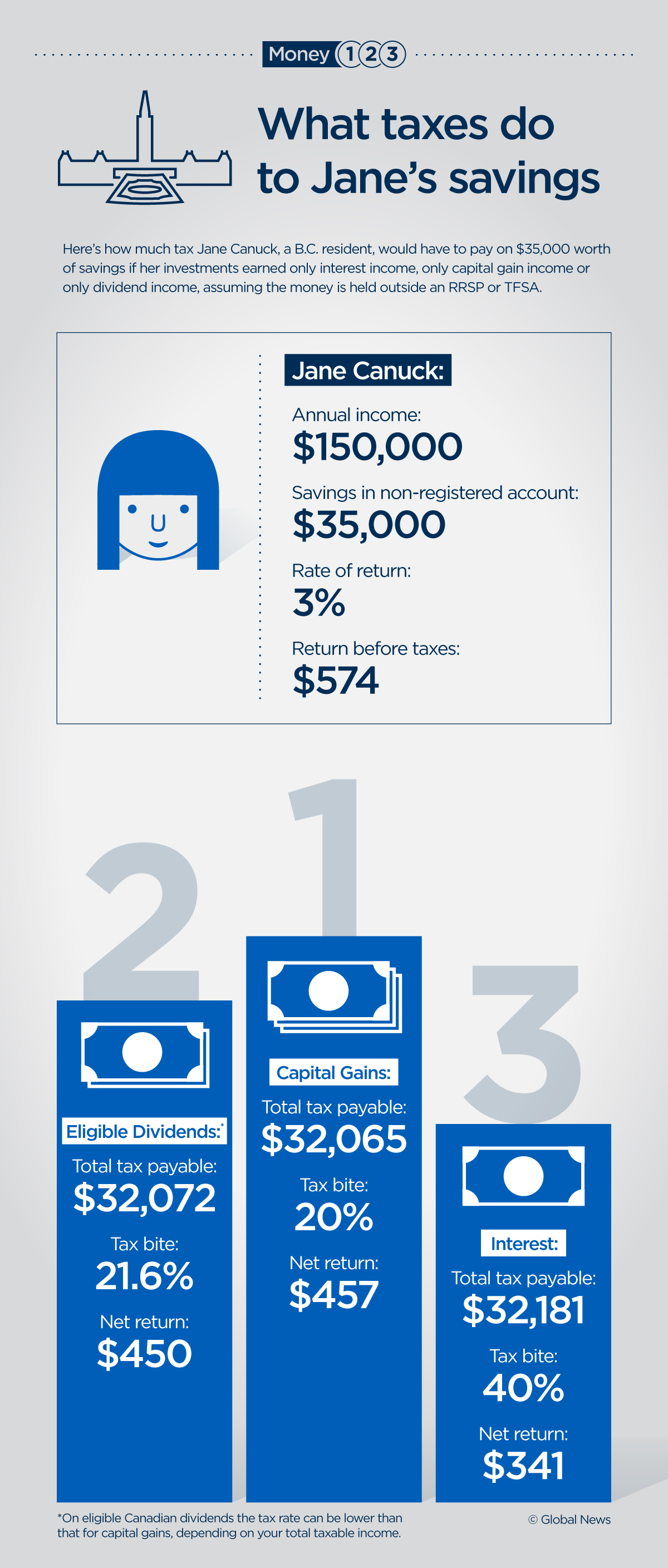

Here S What Taxes Can Do To Your Savings If You Re Not Careful National Globalnews Ca

How Capital Gains Tax Works In Canada Nerdwallet

Tax Efficient Investing Strategies Canada Financial Iq By Susie Q

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Taxation Of Investment Income Within A Corporation Manulife Investment Management